According to Korea Exchange, HYBE’s stock price was trading at 100,300 won as of 9:47 a.m., a decrease of 2.06% from the previous trading day. Although the closing price of HYBE’s stock price exceeded 200,000 won over the last two trading days, it fell below 200,000 won early in today’s session. HYBE’s stock price once fell to 199,000 won.

At the same time, SM is trading at 92,200 won on the KOSDAQ market, a drop of 3.76% from the previous trading day. At one point, SM stock price fell to 90,100 won, almost falling below 90,000 won.

Earlier, HYBE announced that they would dispose of 755,522 shares of SM at 95,531 won per share before the market opened. Through this, HYBE liquidated part of its stake in SM for 68.4 billion won.

At the time of the previous day’s demand survey, HYBE planned to sell a basic quantity of 750,000 shares and up to 940,000 shares with a discount rate of 4-5.5%. In fact, only the basic quantity was disposed of in the block deal, and the maximum discount rate was applied.

In February last year, HYBE acquired 14.8% stake in SM from former SM executive producer Lee Soo-man at 120,000 won per share and secured an additional 0.98% stake through a public tender offer in a dispute with Kakao and SM over management rights. After they went to Kakao’s side, HYBE responded to the tender offer and reduced its stake to around 8%. However, due to the exercise of Lee Soo-man’s remaining 3.65% stake put option, HYBE’s stake increased to 12.58%.

Due to this block deal, HYBE is estimated to have lost 22.3 billion won through the purchase and sale of SM shares. Both HYBE and SM artists are making comebacks, but they are overshadowed by the block deal.

On the 24th, HYBE artists NewJeans and BTS’s RM made their comebacks at the same time. In the case of SM, their representative group aespa officially returned to the K-pop scene by holding a showcase to celebrate the release of their full album “Armageddon” on the 27th.

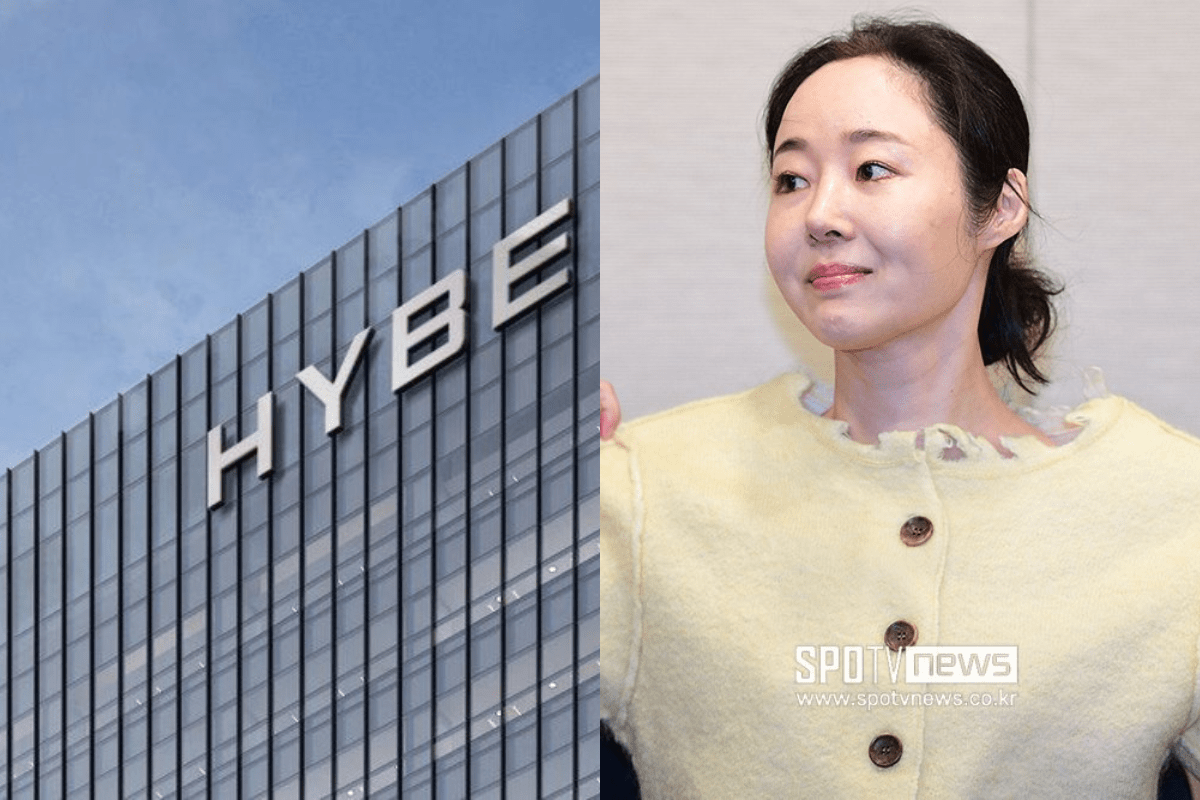

Meanwhile, HYBE’s stock price is expected to face a turning point in the short term with the court’s decision on the injunction filed by ADOR’s CEO Min Hee-jin against HYBE before the shareholders’ meeting on May 31st. In this regard, Hanwha Investment & Securities Park Soo-young shared, “The market will wait until the conclusion over the management rights dispute between HYBE and ADOR”, adding “It is necessary to see how HYBE handles this incident”.

In addition, the direction of lifting China’s ban on Korean cultural content may also have a significant impact on the stock prices of HYBE and SM. Korea Investment & Securities researcher Ahn Do-young said, “If concerts are allowed in China, SM may earn more than 10 billion won per tour. SM will gain the biggest revenue, followed by YG. JYP and HYBE will benefit the least from this”.